Accounting and finance are built on precision, consistency, and trust. For decades, these fields relied heavily on human oversight, manual checks, and conservative processes to ensure accuracy. Artificial intelligence is now changing how this work is done, but not in the dramatic way often portrayed. Instead of replacing professionals, AI is reshaping how routine financial work is handled and how insights are generated from growing volumes of data.

The discussion around AI in accounting and finance has shifted from experimentation to adoption. Firms are no longer asking whether AI is useful. They are asking where it fits, what risks it introduces, and how much control should remain in human hands.

Financial work involves structured data, recurring processes, and strict rules. These characteristics make it well suited for automation. Tasks such as invoice processing, reconciliations, compliance checks, and report preparation follow predictable patterns that AI systems can learn efficiently.

At the same time, finance teams face increasing pressure. Transaction volumes grow every year, regulations evolve constantly, and stakeholders expect faster insights. AI addresses this gap by handling scale without requiring proportional increases in staff.

This does not eliminate the need for accountants or finance professionals. It changes how their time is spent.

The benefits of AI adoption are most visible in day to day operations rather than headline transformations.

As organizations expand, financial complexity grows faster than headcount. AI supports multi-entity consolidations, cross-border compliance, and high transaction volumes without requiring constant staffing increases.

This scalability is particularly valuable for mid sized and large organizations managing multiple subsidiaries.

Despite these advantages, AI introduces serious challenges that cannot be ignored.

AI systems require access to sensitive financial data. This increases exposure to breaches, misuse, and compliance failures if safeguards are inadequate. A single incident can lead to regulatory penalties, reputational damage, and loss of client trust.

Security is not just a technical issue. It is a governance issue.

AI models learn from historical data. If that data reflects bias or incomplete coverage, the system may produce unfair or misleading outcomes. This is especially problematic in areas such as credit scoring, risk assessment, and fraud detection.

Without regular audits and human oversight, biased outputs can go unnoticed.

Implementing AI in accounting environments often requires changes to legacy systems, data cleanup, and staff training. For smaller firms, these upfront costs can delay return on investment and slow adoption.

Regulators increasingly expect explainability in automated decisions, which adds complexity to deployment.

AI performs well with structured problems. It struggles with nuanced scenarios that require contextual understanding, professional skepticism, or ethical reasoning. Overreliance on automation can lead to oversight failures when exceptions occur.

Human judgment remains essential.

In practice, AI is applied selectively rather than universally.

In accounting, AI assists with document processing, transaction categorization, audit sampling, and variance analysis. In finance, it supports risk modeling, anti money laundering checks, forecasting, and trading analysis.

Many organizations use a hybrid approach where AI flags issues and humans make final decisions. This balance reduces risk while capturing efficiency gains.

The tools gaining traction are not general purpose platforms. They focus on specific financial workflows and integrate with existing systems.

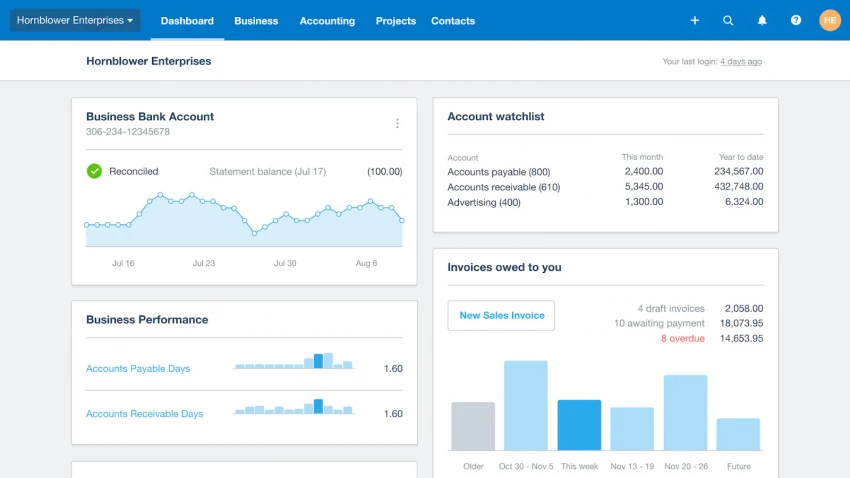

Xero is widely used for small and mid sized business bookkeeping. Its AI features focus on automated bank reconciliation, transaction categorization, and cash flow insights.

The tool reduces manual data entry and improves visibility into daily financial activity. Its value lies in consistency rather than advanced analytics. Firms still rely on human review for judgment calls and compliance decisions.

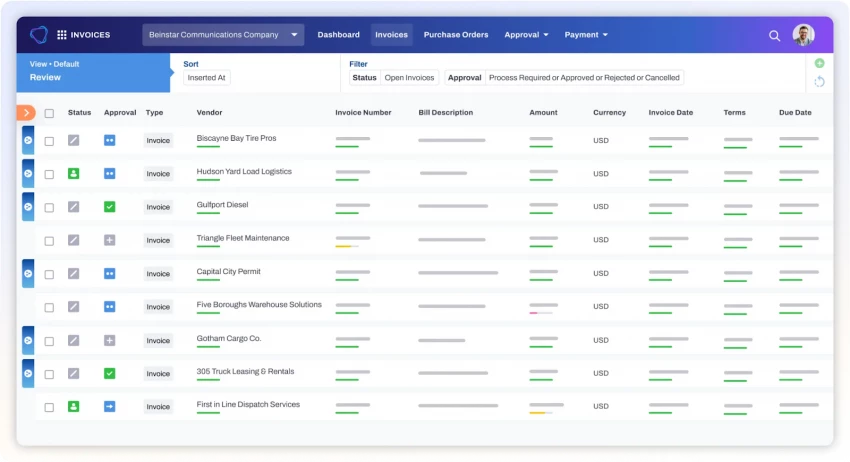

Vic.ai specializess necessary for exceptions and approvals.

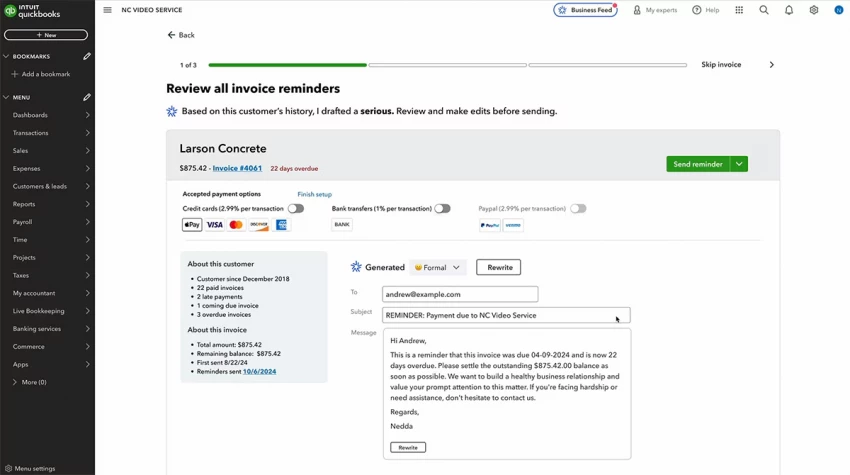

QuickBooks integrates AI into tax compliance, expense categorization, and reconciliation workflows. It is often adopted by small firms and independent professionals.

The AI assists with organizing data and identifying inconsistencies. It does not replace accounting judgment but reduces preparation time and clerical effort.

Across case studies and firm level adoption, AI delivers measurable efficiency gains when applied to clearly defined, repetitive tasks. It reduces errors, accelerates reporting, and improves visibility.

However, success depends on governance, data quality, and realistic expectations. AI systems amplify existing processes. They do not fix broken ones.

The role of AI in accounting and finance is becoming clearer. It is not a replacement for professionals, nor is it a shortcut to perfect accuracy. Its value lies in removing friction from routine work and enabling faster, more informed decisions.

The benefits are real, but so are the risks. Data security, bias, regulatory compliance, and human oversight remain central concerns. Organizations that treat AI as a support system rather than an authority are better positioned to realize long term value.

As adoption continues, the most effective finance teams will be those that combine automation with accountability. AI handles scale. Humans handle judgment. The future of accounting and finance depends on keeping that balance intact.

Discussion