GoMyFinance.com is a financial content and tools platform focused on helping users understand personal finance topics, including budgeting, investing, debt, and credit scores. The site publishes educational articles and tools on financial literacy. It explicitly states that its content is informational and educational only and that it is not a registered financial institution or credit bureau.

GoMyFinance provides a credit score monitoring and interpretation tool that aims to:

● Give users an accessible way to view their credit score.

● Break down factors affecting credit (e.g., payment history, utilization).

● Offer explanations and guidance on what the score means.

Crucially, the publicly available information on GoMyFinance sites does not disclose:

● Whether the score displayed is from an official credit bureau (like CIBIL, Experian, Equifax/CRIF High Mark/TransUnion) or a proprietary estimate.

● Which credit bureau’s data feeds the score.

● The actual data source, algorithm, or whether it pulls a consumer’s real credit file from a bureau.

Limitation: GoMyFinance does not clearly disclose the credit bureau model behind its credit score feature. This means it may be an estimate or an interpretation rather than the official score lenders use. This is a transparency gap consumers should know.

Understanding credit scores in India helps you evaluate GoMyFinance’s offering.

In India, credit scores typically range from:

| Score Range | What It Suggests |

| 300–549 | Poor |

| 550–649 | Fair |

| 650–749 | Good |

| 750–850 | Very Good/Excellent |

Bureaus like CIBIL / TransUnion, Experian India, Equifax India, and CRIF High Mark generate these scores based on your credit file.

All major credit bureaus use similar factors, including:

1. Payment History – Did you pay bills on time?

2. Credit Utilization – How much of your available credit you’re using.

3. Length of Credit History – How long your accounts have been active.

4. New Credit Inquiries – Too many credit applications recently can lower your score.

5. Credit Mix – Variety of credit types, like cards and loans.

GoMyFinance explains these general factors in articles aimed at educating users. (GoMyFinance)

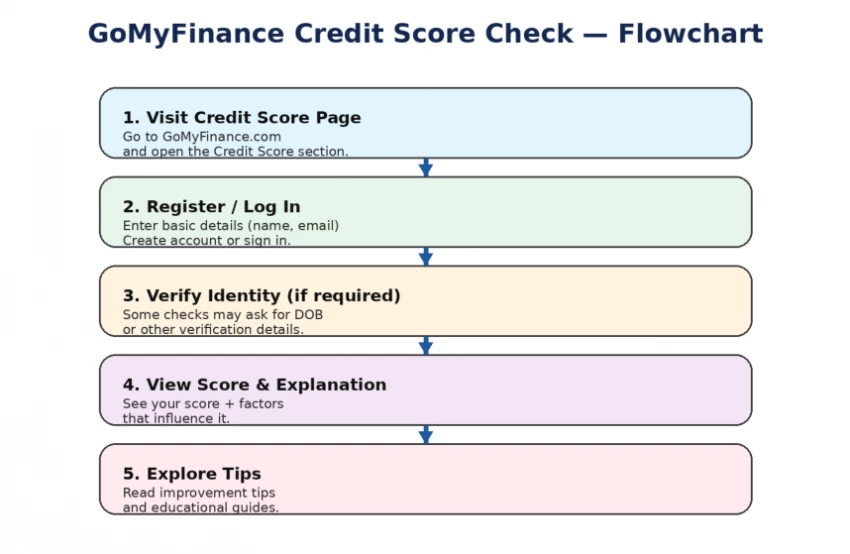

While the precise flow can vary over time, the typical process looks like this:

Note: Because GoMyFinance doesn’t clearly state its data source or bureau affiliation, this “check” may not be the official score lenders see.

Here’s a comparison of GoMyFinance against well-known credit score tools in India.

| Feature / Tool | GoMyFinance.com | CIBIL (TransUnion CIBIL) | Experian India | Paisabazaar |

| Track Credit Score | Yes | Yes | Yes | Yes |

| Official Bureau Data | Not clearly disclosed | Yes | Yes | Often sourced via partners |

| Recognized by Lenders | Not official | Yes | Yes | Depends on source |

| Free Score Access | Yes | Limited free/paid | Limited free/paid | Paid for detail

|

| Detailed Credit Report | Typically not | Yes | Yes | Depends on plan |

| Educational Guidance | Yes | Limited | Moderate | Moderate |

Interpretation: Only bureau tools (CIBIL/Experian) deliver scores officially used by lenders. GoMyFinance and Paisabazaar are generally good for education and estimates but not lender-recognised credit decisions.

● GoMyFinance openly states its mission to educate, not provide financial advice.

● BUT it does not clearly disclose its credit data source — a major transparency limitation.

Always review the platform’s privacy policy before submitting sensitive information like financial details or identity markers.

Because GoMyFinance doesn’t state the bureau model or data source, its credit score should be treated as an estimate or commentary, not an official score lenders use. That affects how much weight you should give it in real financial decisions.

GoMyFinance can be useful because it gives you basic credit-score learning without paying or going through a complicated process.

So instead of just showing a number and leaving you confused, it helps you understand things like:

● why your score might be low

● what affects it

● what habits improve it over time

Think of it like a “credit score starter guide” that makes the topic less scary for beginners.

A big issue with credit scores is that people see the score but don’t know what caused it.

GoMyFinance usually makes it easier by breaking down credit factors such as:

● payment history (late payments hurt a lot)

● credit utilization (using too much limit = score drop)

● credit age (older accounts = better)

● inquiries (too many loan/credit card checks = risky signal)

This is helpful because it turns your credit score into something you can actually work on, instead of just staring at it like a school report card.

If someone is new to credit scores, GoMyFinance works as a first step platform because it’s simpler than official portals and doesn’t feel “bank-like.”

It’s good for:

● students

● first-time credit card users

● people who never checked their score before

● anyone trying to understand credit basics before applying for loans

Basically, it’s a “learning + awareness tool” more than a final authority.

This is a big drawback.

The issue is: GoMyFinance may show a score, but if they don’t clearly mention:

● which bureau it comes from (CIBIL / Experian / Equifax / CRIF High Mark)

● which scoring model they use

● whether it’s real-time or estimated

…then you can’t fully trust it as “official.”

So the score may be useful for reference, but it’s risky to treat it like the same score a bank will check.

Even if the score is real, lenders may see something different because:

● banks may pull your score from a different bureau

● they may use a different version/model

● the lender might also use internal risk rules (income, job type, existing loans, etc.)

So your GoMyFinance score might say 720, but your bank might see 690 or 740 depending on their bureau + system.

That’s why it’s better to treat it as a “directional score” rather than a guaranteed final score.

This is where people mess up.

Some users will think:

“The score looks fine, I’m definitely getting that loan.”

But if the platform isn’t confirmed official, you might miss things like:

● an old unpaid loan showing in your bureau report

● wrong personal info linked to someone else’s account

● a late payment you forgot

● a hidden “settled” status that hurts loan approval

So GoMyFinance can guide you, but before you take any serious step like applying for a loan or credit card, you should verify using an official bureau report.

Q: Is the GoMyFinance credit score accurate?

A: GoMyFinance may offer a helpful estimate and explanation, but it does not clearly disclose whether it uses official credit bureau data. Therefore, treat its score as an educational reference, not the credit score lenders use.

Q: Does checking my GoMyFinance credit score reduce my credit score?

A: No. Tools like these usually perform a soft check that does not affect your credit score.

Q: Can lenders see my GoMyFinance credit score?

A: No. Lenders rely on official credit bureau scores (e.g., CIBIL/Experian), not third-party educational scores.

Q: Should I rely solely on GoMyFinance for credit guidance?

A: Use it as a learning and monitoring tool, but always confirm critical decisions with an official credit bureau report.

GoMyFinance.com credit score tools are useful educational resources for understanding credit basics and tracking general trends. However, they do not replace official bureau credit reports from CIBIL, Experian, Equifax, or CRIF High Mark. Before major financial decisions, always check your official credit report directly with a recognised bureau.

Discussion