GomyFinance.com is an intelligent money management platform designed to help you track, budget, and grow your savings. Its goal is simple: make financial management effortless, even for someone who isn’t a finance expert.

I personally linked my bank accounts and credit cards, and within minutes, the platform automatically categorized my spending, showing me exactly where my money was going.

● Automatic Expense Tracking: Every transaction is recorded and categorized, no manual logging needed.

● Savings & Investment Recommendations: Expert-backed insights tailored to your income and goals.

● Goal Setting: Track multiple financial objectives like travel, home purchase, or retirement.

● Bill Reminders: Never miss a due date or pay unnecessary late fees.

● User-Friendly Dashboard: Even non-tech-savvy users can get started immediately.

Compared to apps like MoneyView or Walnut, GomyFinance.com feels more personalized, with interactive dashboards and actionable insights rather than just data summaries.

Before I started using GomyFinance.com, I struggled with:

1. Impulse Spending: Online shopping and instant deliveries made it easy to overspend.

2. No Budget Awareness: I didn’t know how much I truly earned versus spent.

3. No Emergency Fund: Unexpected expenses drained my savings quickly.

4. Debt Pressure: Credit cards and EMIs silently chipped away at disposable income.

5. Inconsistent Saving Habits: Without a system, saving felt optional and inconsistent.

GomyFinance.com directly addresses these pain points with automation, reminders, and goal-based planning.

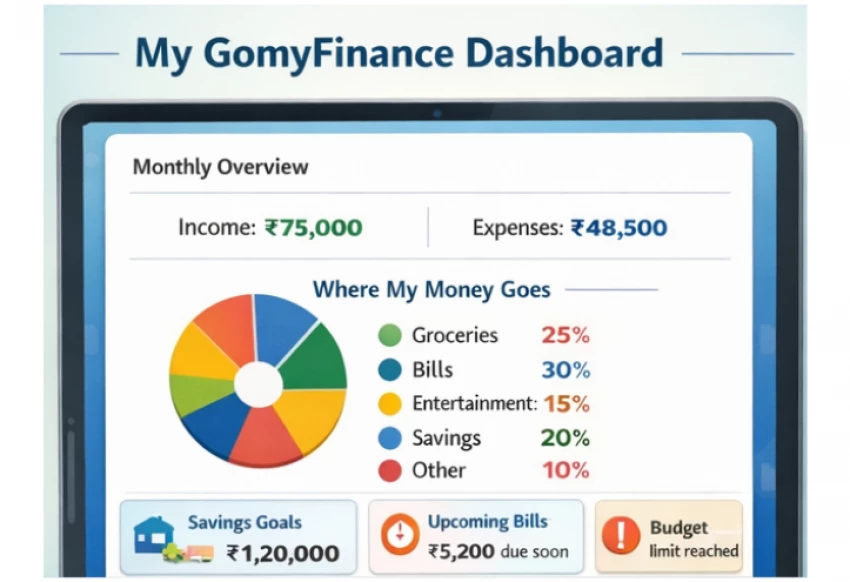

The dashboard gives a clear picture of your income, spending, and savings in real-time. You can see exactly how much is going to groceries, entertainment, or subscriptions. For me, seeing a visual breakdown of my spending habits was a wake-up call.

Every transaction is automatically categorized. The platform even compares month-to-month spending trends, helping you spot unnecessary expenses.

I set up multiple goals like travel, emergency fund, and retirement and could track progress for each individually.

Every payday, I have a fixed amount transferred to my savings automatically. No effort, no excuses.

The platform gives personalized tips on where to save, how to invest, and even what percentage of your income to allocate toward each goal.

1. Budgeting Tools

○ Allocate funds for different categories

○ Set monthly spending limits

○ Receive alerts when approaching limits

2. Interactive Calculators

○ Estimate savings growth

○ Plan for emergencies and retirement

○ Calculate debt repayment timelines

3. Expense Tracking

○ Get a detailed, real-time breakdown

○ Spot irregular spending quickly

4. Automated Savings

○ Schedule recurring transfers for consistent savings

5. Bill Reminders

○ Avoid late fees and maintain a healthy credit score

GomyFinance.com isn’t just about daily spending it helps prepare for life’s uncertainties:

● Emergency Fund Builder: Calculate and maintain financial backup.

● Retirement Planner: Forecast long-term needs and contributions.

● Debt Repayment Assistant: Create a strategy to pay off debts faster.

● Investment Guidance: Curated suggestions for low-risk investments and diversification.

Compared to Goodbudget, which focuses heavily on envelope budgeting, GomyFinance.com offers a more holistic approach; tracking, automation, and goal-setting in one place.

● 50/30/20 Rule: 50% for needs, 30% for wants, 20% for savings/debt.

● Pay Yourself First: Save automatically before spending.

● Zero-Based Budgeting: Assign every rupee a purpose.

● Automatic Transfers: Ensure consistent saving, even when life gets busy.

● All-in-one platform: Track, save, plan, and invest.

● Intuitive design: Easy to use without prior finance knowledge.

● Actionable insights: Recommendations based on my spending patterns.

● Community forums: Learned from other users’ saving strategies.

● Time saver: Automation reduced hours of manual tracking.

● 1-on-1 financial coaching

● Advanced analytics for savings and investments

● Priority support

● In-depth reports and forecasts

| Feature / Plan | GomyFinance.com | MoneyView | Walnut / Axio | Goodbudget | ET Money |

| Core Focus | All‑in‑one budgeting, savings, and planning | Expense tracking & credit insights | Expense tracking & bill reminders | Envelope budgeting system | Budget + wealth management |

| Automatic Tracking | Bank & card sync (Premium) | SMS/bank sync | SMS & account sync | Manual (Premium adds bank sync) | Full sync |

| Expense Categorization | Visual charts & analytics | Yes | Yes | Manual | Yes |

| Savings & Goal Setting | Multi‑goal tracking | Basic | Basic | Envelope style only | Yes |

| Bill Reminders / Alerts | Yes | Yes | Yes | No | Yes |

| Planning Tools | Emergency / retirement / debt tools | Fairly basic | Basic budgeting insights | Focused on envelopes | Includes SIPs & insurance tracking |

| Community / Coaching | Community + guidance | No | No | No | No |

| Free Plan | Yes – core tracking | Yes | Yes | Yes | Yes |

| Premium Plan | ~$8–$18 / mo (~₹650–₹1,500) | Free + Paid options | Free + Paid options | ~$8–$10 / mo (~₹650–₹800) | Free + Paid options |

| Best For | Beginners to advanced planners | Salaried & expense tracking | Simple everyday expense users | Envelope budgeting fans | Investors + budgeters |

Using the right tool can completely transform how you view and manage your money. Platforms like GomyFinance.com stand out because they combine budgeting, savings goals, future planning, and personalized insights all in one place, something many free budgeting apps don’t fully offer.

That said, if your main priority is simple expense tracking on the go, apps like Walnut/Axio or MoneyView can be lighter, more intuitive alternatives. Meanwhile, Goodbudget is great if you prefer envelope-style budgeting.

In my experience, what really makes the difference isn’t just the app, it's how consistently you use it to learn, plan, and adapt your spending habits. And with a tool like GomyFinance.com supporting you, financial goals feel less overwhelming and much more achievable.

Discussion