Meta has agreed to acquire Manus, a Chinese founded artificial intelligence startup now headquartered in Singapore, in a deal valued at more than $2 billion, according to people familiar with the matter. The move underscores Meta’s escalating push into advanced AI as it races to keep pace with competitors such as OpenAI, Google, and Microsoft.

The acquisition, which is expected to close in early 2026 pending regulatory approvals, would give Meta immediate access to a fast growing AI agent product, a paying user base, and technology developed outside the United States at a time of rising geopolitical scrutiny around AI.

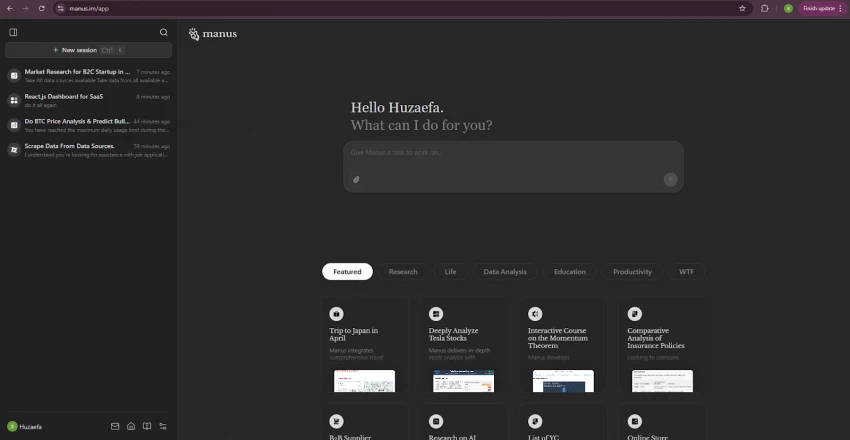

Manus markets itself as a general purpose AI agent rather than a chatbot. Its software is designed to autonomously plan and complete multi step tasks, including research, content generation, scheduling, and workflow automation, with minimal human oversight.

The company operates a subscription based business aimed at professionals and small teams, and it claims millions of registered users globally. Industry analysts describe Manus as one of the first AI agent platforms to demonstrate meaningful paid adoption.

Manus was founded by Chinese entrepreneurs and initially incubated by Beijing based Butterfly Effect Technology. It raised funding from a mix of US and Chinese investors, including Benchmark and Tencent, before relocating its headquarters to Singapore in 2025.

As part of the acquisition, Manus has said it will sever all remaining Chinese ownership ties and discontinue operations in mainland China. Meta has stated that there will be no ongoing Chinese ownership interests after the transaction, a step likely aimed at easing concerns from US and European regulators.

Meta said it plans to continue offering Manus as a standalone service while integrating its AI agent capabilities across Meta AI and consumer platforms such as WhatsApp, Messenger, and Instagram. The company also sees opportunities to expand Manus into enterprise tools and developer focused APIs.

Executives view the acquisition as a way to accelerate Meta’s transition from experimental AI features to practical automation tools that can generate subscription and business revenue, reducing reliance on advertising.

The deal is expected to draw attention from competition and national security regulators, given Meta’s market power and the cross border transfer of AI technology. Lawmakers have increasingly warned about concentration in AI development and the risks associated with opaque data flows.

For Meta, the acquisition represents a high stakes bet that agentic AI will become a core layer of future digital services. Whether the purchase strengthens Meta’s competitive position or adds to regulatory pressure will become clearer as the deal moves toward completion.

For Meta, the Manus acquisition reflects the growing pressure on major technology companies to move beyond AI research and deliver products that generate real usage and revenue. Buying an established AI agent allows Meta to shorten development timelines at a moment when competition in the sector is intensifying.

At the same time, the deal highlights broader questions facing the AI industry. Regulators in the United States and Europe are expected to closely examine how the transaction handles data access, model governance, and the legacy of Manus’ Chinese origins. Any conditions imposed could shape how similar cross border AI acquisitions are treated in the future.

As AI agents begin to move from experimental tools into everyday digital services, the Meta Manus deal may serve as an early indicator of how quickly large platforms are willing to spend to secure an advantage. Whether that strategy delivers lasting gains or invites further scrutiny will be closely watched in the months ahead.

Discussion